Let’s face it—owning a car isn’t what it used to be. Between rising costs, maintenance headaches, and the sheer commitment, traditional car ownership is losing its shine for many. Enter car subscription services: the Netflix-for-cars model that’s shaking things up. But is it right for you? Let’s break it down.

The Basics: What’s the Difference?

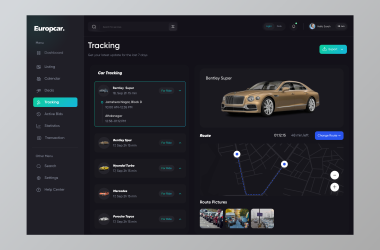

At its core, traditional ownership means you buy a car (outright or with a loan) and handle everything—insurance, repairs, depreciation. Car subscriptions, though? You pay a monthly fee to access a vehicle, often with maintenance, insurance, and even roadside assistance bundled in. No long-term loans, no trade-in hassles.

Cost Showdown: Upfront vs. Ongoing

Here’s where things get interesting. Traditional ownership has that big upfront cost—down payments, taxes, fees—followed by monthly loan payments. Subscriptions? Usually just a signup fee and a flat monthly rate. But—and this is key—over time, subscriptions can add up. Here’s a quick comparison:

| Expense | Traditional Ownership | Car Subscription |

| Upfront Cost | $5,000–$10,000+ | $500–$1,500 |

| Monthly Payment | $300–$700 (loan) | $400–$1,200 |

| Insurance | $100–$200/month | Often included |

| Maintenance | Your problem | Their problem |

See the trade-off? Subscriptions simplify your life but might cost more in the long run. Ownership demands more effort but can be cheaper if you keep the car for years.

Flexibility: The Real Game-Changer

Honestly, this is where subscriptions shine. Want to swap your sedan for an SUV for a road trip? Done. Tired of your car after six months? Cancel and walk away. Traditional ownership locks you in—selling a car is a hassle, and leases come with penalties.

Who Benefits Most from Flexibility?

- City dwellers: Need a car sometimes but not always? Subscriptions adapt to your rhythm.

- Tech enthusiasts: Love having the latest features? Swap cars as new models drop.

- Remote workers: If your commute is sporadic, why pay for a car that sits idle?

The Hidden Costs (Yes, They Exist)

Subscriptions aren’t all rainbows. Some pitfalls:

- Mileage limits: Many cap your driving—exceed it, and fees pile up.

- Vehicle availability: Popular models? They might be “out of stock.”

- Credit checks: Surprise! Your subscription approval isn’t guaranteed.

Ownership has its own demons—depreciation, surprise repair bills—but at least you’re in control.

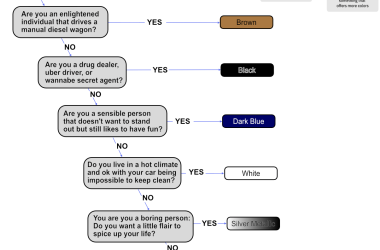

The Emotional Factor

Here’s something calculators miss: attachment. For some, a car isn’t just transport—it’s their car. The one they customize, name, and bond with. Subscriptions? They’re transactional. If you’re the type who sees cars as tools, no problem. But if you’re emotionally invested? Ownership wins.

Future-Proofing: What’s Next?

Car subscriptions are growing fast, especially among younger drivers who prioritize access over assets. And with EVs evolving rapidly, avoiding long-term commitments makes sense—who wants to be stuck with outdated battery tech?

That said, ownership isn’t disappearing. For families, rural drivers, or anyone who values stability, buying still rules.

So… Which One?

It’s not black and white. Subscriptions offer freedom but at a premium. Ownership demands responsibility but pays off over time. Maybe the real question is: How much does convenience weigh in your life? Because in the end, that’s what you’re buying—or not buying—into.