Remember when getting a car meant two things: a hefty down payment and a five-year relationship with a bank? Well, that model is getting a serious run for its money. Literally. Enter the car subscription—a Netflix-like model for your wheels that’s flipping traditional auto finance on its head.

You know the feeling. The moment you drive a new car off the lot, it depreciates. You’re locked into maintenance costs, insurance hikes, and that sinking feeling when a new model comes out. Subscription services promise an escape hatch: one monthly fee covering almost everything—the car, insurance, maintenance, even roadside assistance. It’s tempting. But is it financially savvy? Let’s peel back the glossy marketing and look at the real dollars and cents.

What Exactly Are You Paying For? The All-In-One Fee

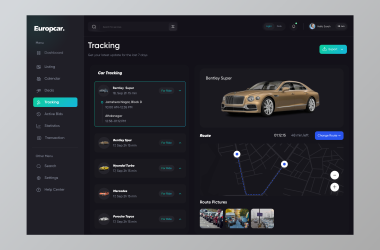

At its core, a car subscription bundles the fragmented costs of car ownership into a single, predictable payment. Think of it like an all-inclusive resort versus booking your own flight, hotel, and meals separately. The convenience is the main sell.

A typical monthly fee for a mainstream sedan or SUV might range from $500 to $1,500. For that, you usually get:

- The vehicle itself (often a late-model car).

- Comprehensive insurance coverage.

- Scheduled maintenance and wear-and-tear items.

- Roadside assistance.

- Sometimes, even registration and fees.

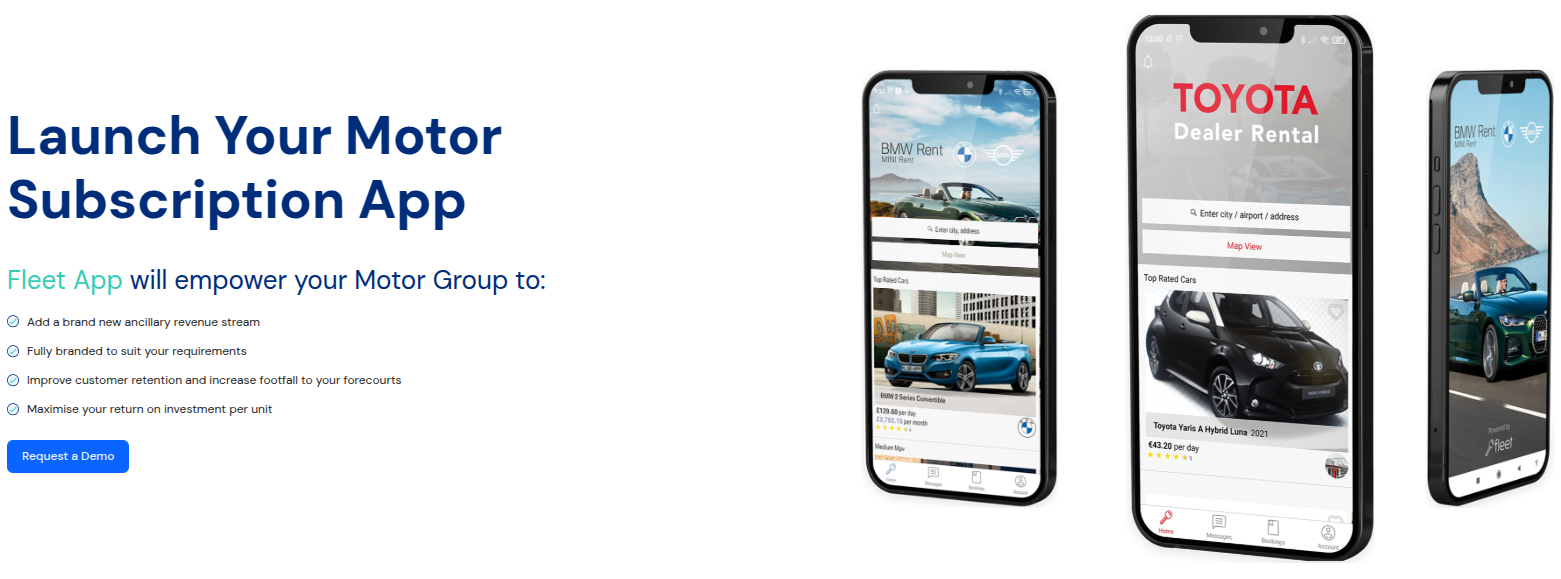

The key differentiator from a lease? Flexibility. Contracts are often month-to-month, with the option to swap vehicles—trade that sedan for an SUV for a summer road trip, perhaps. That’s the dream they’re selling: ultimate flexibility with no long-term strings attached.

The Financial Implications: Convenience vs. Cost

Here’s the deal. You’re paying a premium for that convenience and flexibility. It’s crucial to run the numbers against traditional car ownership or leasing, especially if you’re considering a long-term car subscription.

The Upfront Savings Illusion

Sure, there’s usually no massive down payment. That’s a huge win for cash flow. But over time, the higher monthly payments can eclipse what you’d pay on a loan. You’re essentially financing that convenience—and the provider’s profit margin—every single month.

Let’s put it in a simple table. This is a rough comparison, but it illustrates the point:

| Cost Factor | Traditional Loan (New Car) | Car Subscription |

| Upfront Cost | High (Down Payment + Fees) | Low (Often just first month + startup fee) |

| Monthly Outlay | Lower, fixed payment | Higher, all-inclusive payment |

| Long-term Cost (5 yrs) | You own a (depreciated) asset | You own nothing, total cost likely higher |

| Financial Risk | You bear depreciation, repair risk | Provider bears most operational risks |

The Hidden Cost of Flexibility

That month-to-month freedom? It’s a double-edged sword. Providers can adjust rates more easily, and you have zero equity building. It’s a pure expense, like rent. For some, that’s a perfect trade-off. For others, it feels like treading water financially.

And then there’s the mileage cap. Just like a lease, you’ll have limits. Go over, and those per-mile charges can sting. Honestly, if you’re a high-mileage driver, most subscription models start to look… less ideal.

Who Actually Benefits from This Model?

It’s not for everyone. But for specific lifestyles, the subscription car cost analysis can work out favorably.

The Urban Professional: Someone who might need a car only occasionally, values a premium badge without long-term commitment, and has a higher disposable income for convenience.

The Tech Early Adopter: Someone who craves the newest features—EVs, advanced driver-assist systems—and wants to swap vehicles every few months without the hassle of selling or trading in.

The Life “In-Between”: Think recent transplants to a city, people in the middle of a home purchase who need temporary wheels, or those testing out an electric vehicle lifestyle before fully committing.

For these folks, the peace of mind and flexibility genuinely offset the higher monthly cost. It’s not an investment in a metal asset; it’s an investment in lifestyle fluidity.

A Few Things They Don’t Always Shout About

Look, no model is perfect. There are wrinkles. Credit checks can be stringent—often more like a lease check than a simple rental. That startup fee? It can be a sneaky few hundred dollars. And cancellation terms… read the fine print. Some require a 30-day notice, meaning you’re on the hook for another payment even if you turn the car in today.

And then there’s the emotional calculus. You never really “bond” with the car. It’s a tool, a service. For some, that’s liberation. For car enthusiasts, it might feel a bit… hollow.

The Bottom Line: Is It Right For You?

So, where does this leave us? The rise of subscription-based car ownership isn’t a fad; it’s a fundamental shift in how we access mobility. It responds to a growing desire for experiences over assets, flexibility over permanence.

Financially, it’s rarely the cheapest long-term option. If your primary goal is minimizing transportation cost over 5+ years, a well-chosen used car with a careful budget for upkeep will almost always win.

But cost isn’t everything. The real value proposition is in converting unpredictable, stressful costs (a $1200 repair bill, an insurance spike) into a predictable, manageable line item. You’re buying certainty. And in an uncertain world, that has a price tag many are increasingly willing to pay.

The final question isn’t just about your wallet. It’s about your life. How much is your peace of mind—and your freedom to change gears on a whim—actually worth? The answer to that is deeply personal. And for the first time, the auto industry is giving you a real way to pay for it, month by month.