Let’s be honest—navigating auto insurance as a gig economy driver or rideshare worker can feel like driving through a maze blindfolded. Traditional policies weren’t built for the stop-and-go, app-driven hustle of rideshare or delivery work. And if you’re not careful, gaps in coverage could leave you financially exposed. Here’s the deal: you need a policy that flexes with your gig.

Why Standard Auto Insurance Falls Short

Your personal auto insurance? It’s like wearing flip-flops to a construction site—fine for some situations, but dangerously inadequate for others. Most personal policies exclude commercial use, meaning the second you turn on your rideshare app or accept a delivery, you’re likely driving uninsured. Even worse, insurers may deny claims outright if they sniff out gig-related activity.

Imagine this: you’re waiting for a Lyft ping, coffee in hand, when someone rear-ends you. If your insurer finds out you were logged into the app (even without a passenger), they might argue you were “working” and refuse to cover damages. Not ideal.

Key Insurance Options for Gig Drivers

1. Rideshare Endorsements (The Hybrid Solution)

Think of these as policy “upgrades” that bridge the gap between personal and commercial coverage. Companies like Progressive, Geico, and Allstate offer add-ons that kick in during:

- Period 1: App on, waiting for a ride/delivery request

- Period 2: En route to pick up a passenger or order

- Period 3: Passenger/goods in the car

Cost? Usually an extra $15–$30/month. Worth it for the peace of mind.

2. Commercial Auto Insurance (The Heavy-Duty Option)

If you’re driving full-time or juggling multiple gigs, a commercial policy might fit better. These cover all driving scenarios—personal, rideshare, delivery—but come with higher premiums (think $200+/month).

3. Platform-Provided Coverage (The Partial Safety Net)

Uber, Lyft, and DoorDash offer liability coverage while you’re actively on a trip, but it’s often bare-minimum. Deductibles can be brutal ($2,500+), and collision coverage isn’t always included unless you opt in. Don’t rely on this alone.

Hidden Pitfalls to Watch For

Insurance jargon can be sneakier than a pothole at midnight. Here’s what trips up many gig drivers:

- “Gaps” in coverage phases: Some endorsements only cover Periods 2 and 3, leaving you vulnerable while waiting for requests.

- Delivery vs. rideshare differences: Food delivery gigs sometimes fall under different rules—verify with your insurer.

- State variations: California and New York mandate certain coverage levels; Texas and Florida? Less so.

Cost-Saving Tips Without Sacrificing Coverage

Yeah, premiums sting. But cutting corners could cost you more later. Try these legit savings tricks:

- Bundle policies: Some insurers discount rideshare endorsements if you also have renters/home insurance with them.

- Raise deductibles cautiously: A higher deductible lowers monthly payments, but make sure you can afford the out-of-pocket hit if needed.

- Track your miles: Low-mileage discounts apply even to gig work—just be honest about usage.

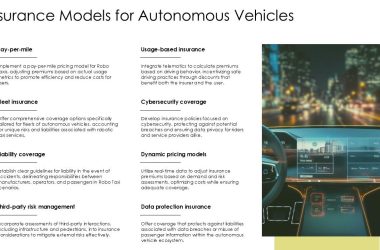

The Future of Gig Worker Insurance

Change is coming. Some startups now offer pay-as-you-go insurance, where you’re only billed for active driving hours. Others are pushing for gig platforms to contribute more to worker coverage. For now? Stay proactive. Review your policy every 6 months—gig work evolves fast, and so should your protection.

At the end of the day, your car isn’t just a vehicle; it’s your office, your livelihood, and sometimes your second home. Insuring it properly isn’t just paperwork—it’s how you keep the engine of your gig economy life running smoothly.